Table of Content

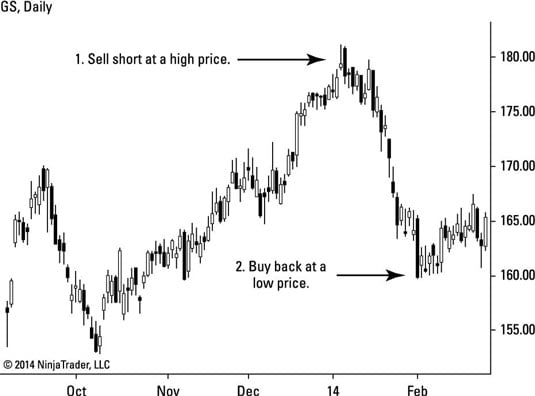

It is a bearish position for that cause, since your aim could be to short shares at a better value than what you buy the shares again for to shut the place. It is the precise reverse of proudly owning a hundred shares of stock, except there is no cap to how high a stock price can go, which is necessary to maintain in mind. But there is additionally bare short selling — the illegal apply of quick promoting shares that the investor by no means truly obtained. Naked quick sellers acquire cash by selling unavailable or nonexistent shares. They hope that shares will turn into out there before the end of the clearing window so that they'll actually buy those shares and close out their brief before the preliminary sale is even finalized.

Therefore, it’s top-of-the-line short-term shares to purchase now. Over the trailing 5 days, PATH gained 18% whereas in the trailing month, it’s up practically 35%. However, global recession fears makes UiPath a less-convincing idea. It’s obtained the wind to its back, making it top-of-the-line short-term shares to buy now.

What Are Hedge Funds? | Hedge Funds Explained | Titan

Tastytrade content material is provided solely by tastytrade, Inc. (“tastytrade”) and is for informational and academic purposes solely. It is not, neither is it intended to be, trading or funding recommendation or a recommendation that any safety, futures contract, transaction or funding strategy is suitable for any particular person. Trading securities can contain high risk and the loss of any funds invested. Tastytrade, via its content, financial programming or in any other case, does not provide investment or financial advice or make funding suggestions.

Short selling feels like a fairly easy idea in theory—an investor borrows a stock, sells the stock, after which buys the stock back to return it to the lender. In practical terms, however, it is a sophisticated technique that solely experienced traders and merchants should use. For instance, after oil costs declined in 2014, General Electric Co.’s vitality divisions began to pull on the performance of the entire company. The quick interest ratio jumped from less than 1% to more than 3.5% in late 2015 as short-sellers began anticipating a decline in the stock. By the middle of 2016, GE’s share value had topped out at $33 per share and commenced to decline. By February 2019, GE had fallen to $10 per share, which might have resulted in a profit of $23 per share to any brief sellers lucky enough to short the stock close to the highest in July 2016.

Monetary Literacy Strengthens Your Relationship With Cash

Suddenly, there were very few shares of Volkswagen inventory in the market and high demand of investors who needed to buy shares to return to lenders. Volkswagen's inventory then skyrocketed as investors were frantic to repurchase shares at a better worth. In a brief squeeze, the inventory typically falls to its regular vary within several months, as did Volkwagen's.

When shorting, being too early is commonly the same as being incorrect. Most good brokers cost very low commissions, and they are even free in many cases. Amanda Jackson has experience in private finance, investing, and social companies. She is a library professional, transcriptionist, editor, and fact-checker.

What Are Mutual Funds?

When a inventory has technical problems, it'll probably fall in worth. When you short a stock, you promote shares of a stock that you don't own. You hope to buy the shares back at a lower cost later so as to revenue from the distinction.

Shorting a stock is subject to its personal algorithm that are different from regular stock investing. At its worst, too much short-selling could have contributed to major financial problems. Receive full entry to our market insights, commentary, newsletters, breaking information alerts, and extra.

For example, suppose an investor thinks that Meta Platforms Inc. , formerly Facebook, is overvalued at $200 per share and can decline in worth. In that case, the investor might "borrow" 10 shares of Meta from their dealer after which sell the shares for the present market price of $200. If the stock goes right down to $125, the investor could purchase the 10 shares again at this price, return the borrowed shares to their dealer, and net $750 ($2,000 - $1,250). However, if Meta's share worth rises to $250, the investor would lose $500 ($2,000 - $2,500). Sometimes quick promoting is criticized, and short-sellers are considered as ruthless operators out to destroy corporations.

However, the fact is that quick selling offers liquidity, meaning sufficient sellers and consumers, to markets and can help prevent bad stocks from rising on hype and over-optimism. Evidence of this benefit could be seen in asset bubbles that disrupt the market. Assets that result in bubbles such because the mortgage-backed security market before the 2008 monetary disaster are incessantly difficult or almost unimaginable to quick. When it comes time to shut a position, a short-seller may need trouble discovering enough shares to buy—if a lot of other traders are additionally shorting the stock or if the inventory is thinly traded. Conversely, sellers can get caught in a brief squeeze loop if the market, or a selected stock, starts to skyrocket.

No matter how much analysis you do, or what skilled opinion you acquire, any one of them could rear its ugly head at any time. The time period promote is the process of liquidating an asset in exchange for cash. It usually refers back to the act of exiting a protracted place in an asset or safety. It is feasible that the investor you borrowed the shares from needs the shares for some cause and calls them again. Then you could be compelled to cover your position, which could occur at a nasty time.

Julius Mansa is a CFO advisor, finance and accounting professor, investor, and U.S. Department of State Fulbright research awardee within the subject of financial expertise. He educates enterprise college students on matters in accounting and company finance. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny shares for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. In some cases, restrictions are positioned on short-selling throughout extreme market turmoil.